Our 5 R&C solutions

R&C Technology

We empower your risk managers and compliance officers with world class software.

R&C Technology selection, implementation, and enhancement

R&C Consulting

We support you to realise operational excellence in risk & compliance

Best practice risk & compliance operations

R&C Co-sourcing

Your Value

Become resilient and compliant . . . . together with us

Technology selection: Unlock your full R&C potential with the right technology

Choosing the wrong R&C solution can cost time, money, and future opportunities. At BR1GHT, we ensure that doesn’t happen. We guide you through every critical step guaranteeing a solution that meets your needs today and drives your ambitions tomorrow.

Why BR1GHT is your R&C technology partner:

- ZIndependence: We are independent of any GRC-software supplier.

- ZWe cover the whole process: We support you from building the business case, long-list/short-list functionality identification, market-research, demo's, RFI/RFP to contracting.

- ZQuick start: We selected a few best-practice R&C-solution meeting vision and know them in-depth to provide you a fast insight in what is possible.

- ZFixed pricing, no surprises: We offer transparent, fixed pricing because we know exactly what needs to be done—and how to do it right.

- ZBest-in-class expertise: Our R&C consultants are veterans in risk and compliance processes, ensuring you get the right software that aligns perfectly with your organization’s needs.

- ZProven process: Our trusted and effective methodology has helped countless organizations avoid pitfalls and select the best-fit solutions for long-term success.

- ZMarket insider knowledge: With penetrating insight into the R&C market and its vendors, we give you an edge over competitors by fast-tracking the selection process.

Don’t leave your R&C technology decision to chance. With BR1GHT, you’ll secure a future-proof solution that empowers your organization to excel in managing risks and compliance.

We have in-depth knowledge of all risk & compliance solutions and their vendors, maintaining full independence in your selection process. While we can implement most leading solutions (as recognized in the Forrester Wave), we also resell Wolters Kluwer Enablon, RiskChallenger, Soterion, and CERRIX—aligning with our vision of R&C through combined assurance, AI-driven insights, open APIs, automated controls testing, collaboration, and trust management. We also have our own ‘white-labelled’ R&C-solution, theme focused (with readily available content we can easily implement.

Enablon is a comprehensive R&C solution designed for asset-intensive industries, excelling in Operational Risk Management (ORM) and Environmental, Health, and Safety (EHS). Its advanced functionalities help organizations streamline compliance, risk management, and ESG reporting. With powerful integrations, including Wolters Kluwer’s Tagetik, it ensures high-quality data, effective control treatment, and regulatory compliance. Enablon is a trusted solution used across 160+ countries by multinationals and large enterprises to optimize nonfinancial performance management and reporting.

TM+ is a leading audit and compliance monitoring solution designed to support internal audit and 2nd-line risk management teams. Originally developed for auditors, it has evolved into a versatile R&C tool, enabling banks and financial institutions to enhance compliance monitoring with structured methodologies. With newly integrated ERM functionalities, TM+ extends its capabilities into broader enterprise risk management. The solution is relied upon by over 3,000 organizations worldwide, including major corporations, global audit firms, and public sector agencies.

CERRIX offers a full-suite R&C solution that delivers exceptional value for small to large organizations. It is particularly well-suited for financial institutions, thanks to its embedded form functionalities that streamline KYC/CDD compliance. CERRIX enables organizations to design business processes, link risks and controls, and track actions efficiently. The platform also includes ISQM functionalities, supporting external auditors in implementing and maintaining a robust quality management system to ensure regulatory compliance.

Has built a business- centric agile R&C-solution on top of SAP that enhances accountability of SAP related risk & compliance. It is considered a much cheaper, and easy to implement strong competitor to SAP- R&C. The solution has extensive functionalities to analyse user rights, improve compliance and stay compliant. Quick to install, easy to learn, S/4HANA ready and boasts an award-winning user experience; both on premise, in the cloud or as a managed service.

Innovative solution assists you in identifying, analysing, and controlling risks efficiently and interactively. Increase team engagement and productivity during risk rating process and make risk awareness sessions even more dynamic with QR code participation. Gain a clear overview of all risks and measures using a visual dashboard, analyse and prioritize risks effortlessly with an intuitive tool, and stay informed about progress and risk status through real-time updates and reports.

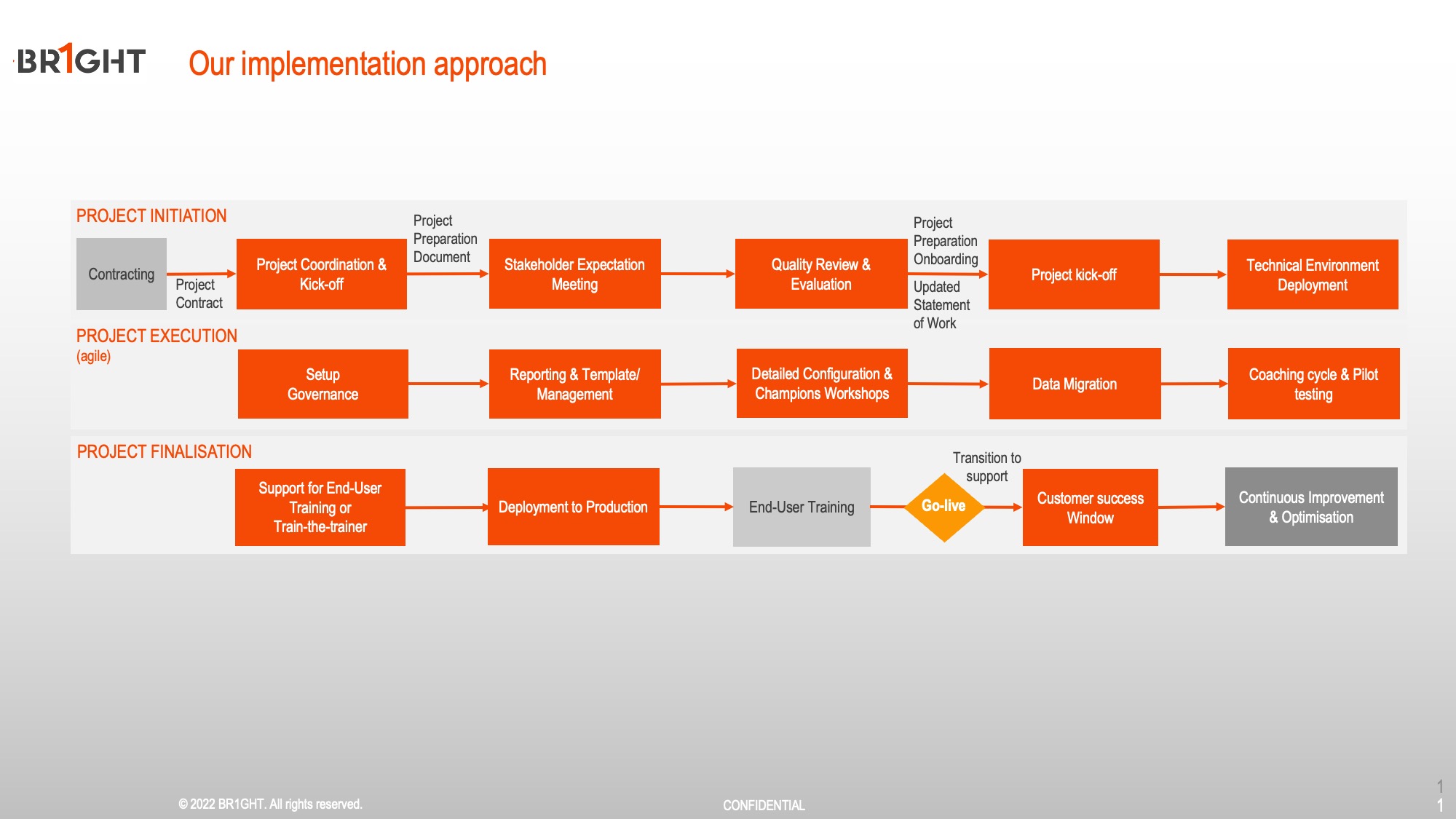

GRC-software implementation

Key benefits of our GRC-software implementation approach:

- ZFixed price projects: Clear scope, no surprises—ensuring transparency and predictability in costs and time needed.

- ZHighly skilled team: Benefit from a team with expertise in both system implementations and risk & compliance, ensuring practical, client-focused solutions.

- ZEmpowering your people: We train and support your team, enabling you to manage and optimise your system confidently from day one.

- ZExtended customer care window: After implementation we help you during the first months to improve your configuration.

- ZValue sessions: At the closing of the implementation, we provide value sessions to define possible enhancements.

- ZAgile enhancements: For extended usage of functionalities of the solution or within new departments, we have a tailored 'agile' enhancement approach.

- ZOngoing support and optimization: Benefit from our subscription service offering configuration updates, user management, training & coaching, and continuous enhancements to maximize the value of your R&C technology investments.

Partnering with BR1GHT equips your risk and compliance functions with the right software needed to excel, now and in the future.

Driving value with technology enhancements

We maximise the value of your risk & compliance technology via our ‘agile’ approach and continuous improvement programs. We support with the definition of your ambition and help you to draw and realise your roadmap.

How we optimize the use and adaptation of your technology:

Streamline and integrate your Compliance Monitoring processes with our technology solutions

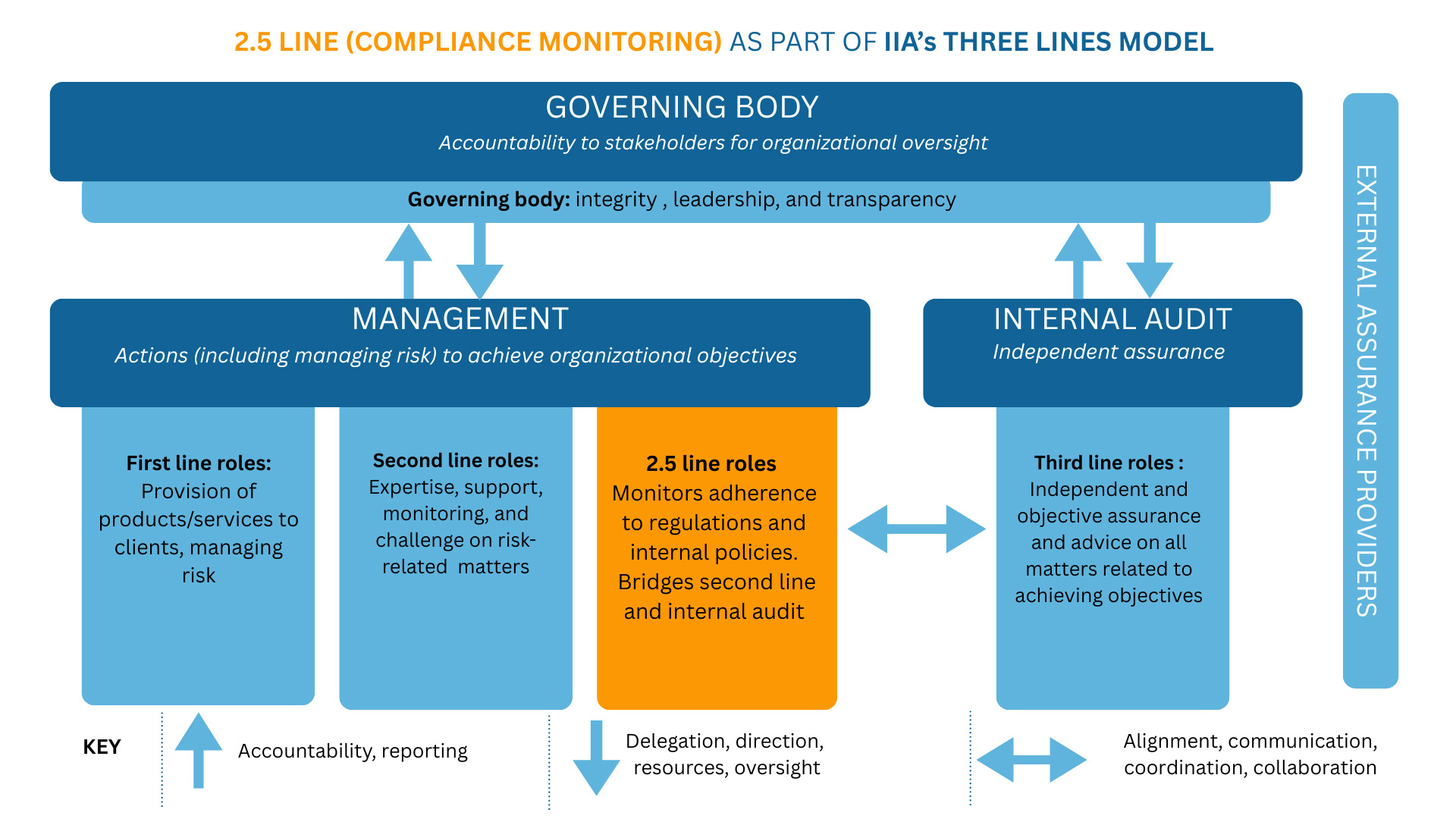

A 2.5 line compliance function is an innovative addition to the traditional Three Lines of Defense (3LOD) model in risk management and compliance. This approach positions a dedicated compliance team between the Second Line (oversight functions) and the First Line (operational/business functions), providing additional oversight, guidance, and support.

2.5 line functions are rapidly becoming a must for highly regulated industries such as banking, healthcare, or energy, where compliance is complex and critical and for larger organizations where multiple business units need consistent compliance implementation across geographies.

Our solution – what we do

Our tooling solutions help organizations streamline compliance monitoring and integrate your governance over all three lines. Our technology solutions:

- Enable automated tracking of compliance monitoring metrics and can send alerts or notifications when there are deviations or potential issues. This helps teams proactively address non-compliance before it escalates.

- Include features for risk assessment and control testing, which help identify areas where the organization may be non-compliant. This risk-based approach enables organizations to focus monitoring efforts where they are most needed.

- Automate workflows and task assignments, streamlining compliance checks and ensuring that each compliance-related task is handled efficiently. This improves team productivity and helps prevent bottlenecks in the compliance process.

- Maintains thorough documentation of all compliance monitoring activities, making it easier for organizations to provide evidence of compliance during audits or regulatory reviews. This clear audit trail is essential for transparency and accountability.

- Provide insights into compliance performance with integrated analytics and customizable reporting. They generate detailed, real-time reports that compliance teams (and auditors) can use to track compliance status, analyze trends, and share findings with stakeholders.

- Allow team members to collaborate, document findings, and communicate more effectively. This shared visibility helps compliance teams work cohesively and ensures that everyone stays informed of compliance issues or changes in regulations.

- Support continuous monitoring, enabling organizations to regularly review their compliance status and make improvements over time. This is especially useful for adapting to evolving regulations and maintaining ongoing compliance.

- Provide a centralized platform for compliance, risk and audit activities. This allows 1st, 2nd, 3rd and even 4th line teams to plan, track, and report risk, compliance and audit efforts in one place, increasing efficiency and reducing the risk of missed issues.

By using our technology solutions, your organization can build a robust compliance monitoring framework that not only helps you meet current regulatory requirements but also strengthens your ability to be transparent to all stakeholders about your compliance status and adapt and respond to future compliance challenges.

Your value

- ZStreamlined compliance oversight as compliance and audit activities are centralised into a unified platform, simplifying management, reducing complexity, and minimizing oversight gaps.

- ZProactive risk mitigation due to leveraged automated tracking, alerts, and risk-based controls to identify and address non-compliance issues before they escalate, supporting a preventive compliance culture.

- ZEnhanced audit efficiency as a result of complete audit trails and clear documentation of compliance actions, making regulatory audits faster, more transparent, and less disruptive.

- ZInsight driven decision making as data analytics are integrated in the tool. Real-time reporting delivers deep insights into compliance trends, enabling evidence-based improvements and better stakeholder communication.

- ZImproved accountability and productivity through automated workflows and task management, ensuring every compliance responsibility is executed efficiently and by the right person at the right time.

- ZA future-proof compliance framework that enables continuous monitoring and adaptation to evolving regulations, helping organizations maintain resilience and readiness in a shifting regulatory landscape.

Read what clients think of our solution

Special offer

Maximize your technology’s potential with our tailored value contracts!

Are you determined to get the absolute best out of your technology? Our three exclusive value contracts are designed to ensure you do just that. Each contract is strategically crafted to align with your unique needs, helping you unlock the full power of your technology investments.

Stay ahead of the curve, drive efficiency, and maximize value—discover how our value contracts can fuel your success today!

Value maintenance

Value enhancement

Diamond value

Special offer

Maximize your technology’s potential with our tailored value contracts!

Are you determined to get the absolute best out of your technology? Our three exclusive value contracts are designed to ensure you do just that. Each contract is strategically crafted to align with your unique needs, helping you unlock the full power of your technology investments.

Stay ahead of the curve, drive efficiency, and maximize value—discover how our value contracts can fuel your success today!

-

Value maintenanceSubtitle

Value maintenanceSubtitle -

Value enhancementSubtitle

Value enhancementSubtitle -

Diamond valueSubtitle

Diamond valueSubtitle

Value maintenance

Throughout the year, we continuously analyze how you utilize your current GRC application configuration. Our goal is to help you unlock more value from your existing technology, enhancing the effectiveness of your GRC functions.

Value enhancement

In well-prepared sessions at the management and board level, we identify opportunities to extract more value from your GRC technology. We help you build a clear vision and define a comprehensive governance program that spans all lines of your organization.

Diamond value

In collaboration with your risk and compliance function, we analyze and optimize your current GRC technology. Additionally, we drive value improvements with technology across all lines, working closely with your board to ensure alignment and maximize impact.

Further use of R&C functionalities

Extend usage of your R&C system

True R&C integration

Data analytics & reporting enhancements

Further use of R&C functionalities

Our solution – what we do

Many risk and compliance teams choose to start small when implementing GRC software — focusing on core workflows to ease adoption and avoid overwhelmed users. This is a smart approach, but often it means that valuable functionality remains untapped. We help you build on your foundation by expanding usage across different R&C modules, optimising configuration, and staying ahead of new releases. Whether it is unused functionality, newly released features, or automation opportunities, we ensure you maximise the value of your existing investment. Our experts work alongside your team to align the system’s capabilities with your audit goals, maturity, and evolving needs.

Your value

- ZExpand usage of existing functionality already included in your license

- ZStay up to date with new features and releases

- ZIncrease efficiency by activating underused automation and analytics tools

- ZImprove user experience with tailored configuration and role-based access

- ZStrengthen risk assessment quality and insights without additional license costs

- ZMaximise return on your current R&C software investment

Read what clients think of our solution

Extend usage of your R&C system to other functions, departments or external parties

Our solution – what we do

GRC software is not just for risk & compliance—our tooling solutions provide powerful platforms that can support IT, quality, finance, logistics, audit and other (assurance) functions. Many organisations start with risk & compliance as a result of regulatory requirements but later recognise the benefits of aligning methodologies, reporting, and workflows across functions & departments. BR1GHT helps you scale your GRC software implementation beyond regulatory risk & compliance management by designing shared frameworks, enabling secure role-based access, and tailoring configurations for each line of defense. We ensure governance teams work more collaboratively, efficiently, and with greater insight—on one integrated platform.

Your value

- ZUnlock cross-functional value without additional systems

- ZAlign methodologies across risk, compliance, audit and quality

- ZEnable secure collaboration with role-based access and data segmentation

- ZReduce silos and duplicate work through integrated planning and reporting

- ZImprove enterprise-wide centralized risk & compliance in-and oversight

- ZIncrease adoption of existing technology across the organisation

Read what clients think of our solution

True R&C integration

Our solution – what we do

Your value

- ZConnect your GRC software with key organisational systems for seamless collaboration

- ZEliminate manual effort and duplicate work through smarter workflows

- ZAccess real-time data to support risk-based decision-making

- ZEnable integrated risk & compliance management and more effective issue follow-up

- ZEnhance the strategic influence of risk & compliance through better visibility

Read what clients think of our solution

Data analytics & reporting enhancements

Our solution – what we do

Your value

- ZTurn risk & compliance data into actionable insights with enhanced reporting

- ZImprove visibility through clear, real-time dashboards and visualisations

- ZStrengthen management reporting with relevant KPIs and trends

- ZHighlight emerging risks and areas for improvement more effectively

- ZReduce time spent on manual reporting and analysis

- ZImprove credibility through data-driven communication

Read what clients think of our solution

Strategic consulting: positioning the Risk & Compliance functions

- ZGovernance structure & oversight for boards - Helping Boards and governance bodies structure and adapt their governance approach with risk & compliance as a key enablers. In more detail: Defining and strengthening governance roles & responsibilities, improving board supervision with reporting, and maximising risk & compliance value to the board.

- ZGovernance support for management - Helping management define governance structures, align assurance functions, and ensure risk & compliance support business priorities. In more detail: Structuring governance & assurance collaboration, aligning risk & compliance with internal audit, and delivering relevant risk insights.

- ZRisk & Compliance’s in New Risks & Regulations - Helping CROs and CCOs and Risk & Compliance Leads adapt to emerging risks, regulatory changes, and evolving risk & compliance requirements. In more detail: Addressing new risk areas, adapting to key compliance, risk & governance frameworks, and strengthening the risk & compliance mandate.

We can provide one-off group training & coaching, individual sessions, but also more continuous reflection & sparring partner sessions. Our tailored programs help Risk & Compliance Leaders towards a clear mission statement, a strong vision and a concrete board enabled roadmap to drive governance with technology. Our support is different depending on the maturity of your corporate governance. We recognise 4 levels of maturity (please click on the options below to read what we can do for you).

Informal and reactive risk & compliance

Risk & compliance defined, but siloed

Risk & compliance actively integrated

The 2nd line as a real-time, strategic, tech-enabled partner

Request your ...FREE strategy session... here!!

Request your ...FREE strategy session here!!

Operational consulting: Building best practice risk & compliance functions

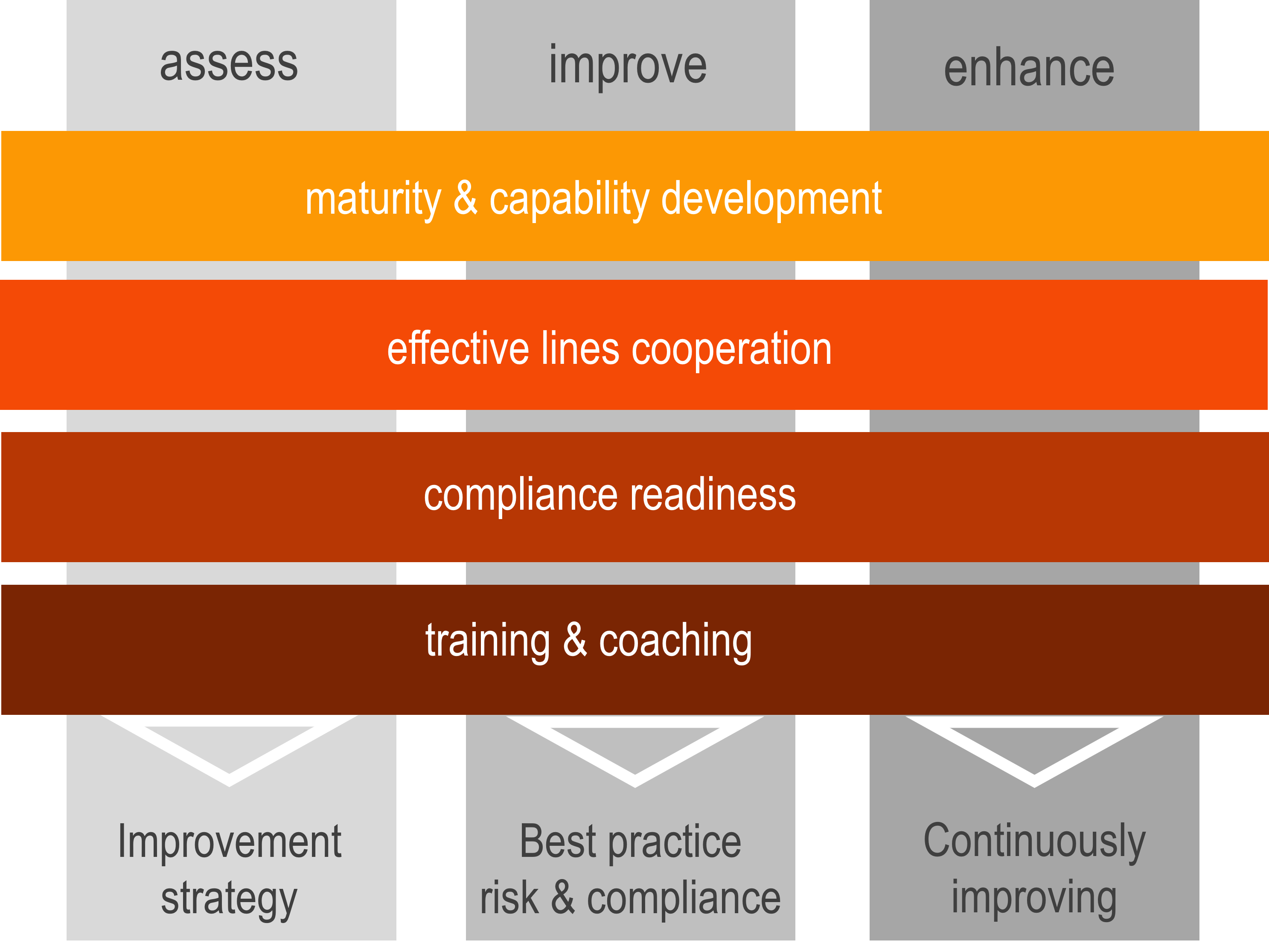

We support Risk & Compliance departments to improve their operational excellence in 3 ways:

- ZAssess and report improvement opportunities - The objectives of our engagements are to identify your current way-of-working and to help you set achievable objectives, with clear advices and if required a concrete roadmap.

- ZRealize the improvements - We help you to realize your desired improvement via hands-on support (we actually build procedures, charters, etc.), best-practice frameworks or via sparring partnering.

- ZHelp continuously enhance - We participate in your improvement or change program within your audit department or in your name in change project (eg, your controls specialist in a SAP implementation, etc.). We do this via a combination of the above a and b together with reflection sessions.

We focus on (please click on the options below to read what we can do for you):

Maturity & capability development

Effective lines collaboration

Compliance readiness

Training & coaching

Informal and reactive risk & compliance

The context defined

The governance environment can be described as informal, with a focus on organising governance and initiating risk treatment. This is not a desirable situation, but can be found in the following cases:

- In sectors where few risks are present and compliance plays little to no role – creative institutions or architectural firms.

- In start-ups or organisations that have undergone significant changes (e.g., mergers or new ownership). These organisations need to (re)structure themselves.

- In small or medium-sized organisations that have never dealt with control issues (such as process errors or fraud) or are unaware of them. These organisations have never truly felt the need for a higher level of internal control.

- In companies where management lacks knowledge of internal control and, as a result, does not see its importance, lacks ambition, or the decisiveness to progress to maturity Level II.

Characteristics

- There is limited knowledge of internal control and, consequently, a low level of intrinsic ambition. Internal control is often viewed as unnecessary and as a cost burden.

- There is no formal risk or compliance structure.

- Risk & Compliance are reactive or driven by incidents. In some cases, an incident has triggered a sense of urgency as the organisation no longer wants to keep reacting and seeks to implement preventive measures.

- There is no or very little policy or procedure documentation, (awareness) training, or formal processes.

- Often, one or more specialists in internal, financial, or operational control are brought in to analyse the situation and provide recommendations for improvement.

- No risk/control ownership taken by the first line, so the above mentioned specialists usually remain involved to implement the measures of improvements: the 2nd line becomes the driver of risk & control management.

The role of the 2nd line

At this foundational level, risk and compliance management are in their infancy. The organization operates primarily in a reactive mode—addressing issues as they arise rather than proactively identifying and managing them. There is little to no structure in place to systematically handle risks or ensure compliance with laws and regulations, so risk & compliance management become driven by the 2nd line.

- The primary role of the 2nd line in is infancy stage is to begin creating awareness across the organization. This includes educating key stakeholders about:

- The types of risks the organization faces (strategic, operational, legal, reputational, etc.).

- The importance of compliance with applicable laws, industry standards, and internal expectations.

- The potential consequences of unmanaged risk (e.g., financial loss, regulatory penalties, reputational damage).

- While largely reactive, this stage involves capturing and analyzing incidents, control failures, or compliance breaches when they occur. These events serve as valuable learning opportunities and can highlight systemic weaknesses.

- In many cases, risk and compliance efforts are driven by external demands—such as regulators, auditors, or clients. The organization begins to understand that meeting these requirements is not optional and starts building minimal capability to address them.

- The role of risk and compliance at this level is not to build complex systems, but to lay the groundwork for structured governance. This includes:

- Advocating for leadership buy-in.

- Establishing minimal policies and internal controls.

- Identifying and logging key risks.

- Promoting awareness of regulatory obligations.

- Preparing the organization to take its first steps toward a defined and repeatable risk and compliance approach (Level 2).

- All of the above activities are often initiated as a project. As the organisation matures, risk management responsibilities will gradually be embedded into the second line.

How BR1GHT can support

- Co-developing a strategic vision, roadmap, and programme with all key stakeholders (board, supervisory bodies, and managers) to establish sound governance.

- Co-developing a basis risk & compliance register. Facilitating risk identification and prioritization for key business areas.

- Help understand which laws and standards apply to your sector/organization and provide initial gap assessments against applicable regulations.

- Providing risk & compliance professionals who conduct initial assessments and translate their recommendations into tangible improvement/control programmes. This gives you access to extensive experience and professionals who understand the context and can effectively foster engagement.

- Supporting the hiring of the right risk or compliance lead to continue the positive trajectory into the future.

- Coaching the risk & compliance lead and assisting in their role — either as a one-time engagement or as part of a longer-term strategic collaboration.

- Coaching and training first-line staff and management (and where relevant, the supervisory board). Our specialised programmes are tailored to your current organisational culture and are designed to enable you to take the next steps independently, while also formulating a mission, vision, and ambition for the years ahead. Our coaching focuses on knowledge transfer and empowering management and key stakeholders.

- Recruiting other key professionals, such as auditors. Our extensive network is at your disposal to find the right person who fits your corporate culture.

- Steering the improvement programme — either actively through a dedicated project leader or passively in a sparring partner role — to ensure the defined ambition is achieved and the programme stays on course.

- Helping organisations visualise risk thinking. We deliver solutions that make this visible and thus accelerate the process.

- Co-sourcing the risk management function from scratch, supporting management directly in building internal capability.

Risk & compliance defined, but siloed

The context defined

Organizations at this level have begun to formalize compliance and risk activities. The governance environment can be described as standardized. Processes are repeatable but often still siloed. Basic controls and policies are in place, yet risk and compliance are typically managed on a case-by-case basis. In some cases, the first line has started developing and executing basic control measures.This is considered the minimum level of internal control. The organisation has evolved from an initially reactive approach to risk management toward a more proactive and risk based mindset focused on implementing preventive measures.

This level of internal control can be found in:

- Unregulated companies without a high-risk profile – simple local trading and manufacturing organisations, consultancy firms, etc.

- Mid-sized organisations under pressure to be financially and operationally predictable – driven internally (e.g., from an international holding company) or externally (due to supply chain requirements).

- Organisations where quality is a key factor in maintaining competitive advantage (often driven by customer requirements) – service sector such as telecommunications & media, universities, universities of applied sciences, food and hospitals.

- Organisations subject to mandatory audits or inspections by external (oversight) parties, where the organization can no longer rely solely on regularly planned audits and needs to be able to prove that they are pro-active and continuously in control.

Characteristics

- Strong need for good governance with a defined risk profile, and a solid system of internal controls.

- Basic governance structure with clear roles and responsibilities for leadership and oversight, as well as policies, guidelines, and procedures.

- Oversight is present – via a holding or an active supervisory board. Risk or Audit committees are still relatively uncommon.

- Good level of specialists – risk managers, internal controllers, (quality) auditors, compliance officers and security officers – organised across the first, second, and third lines.

- Risk and audit mitigation is often still reactive.

- There is little integration between risk and compliance, and these functions may still operate independently.

- Risk and compliance processes are documented and followed in specific departments or business units, but often lack coordination across the enterprise. There is little integration between risk and compliance, and these functions may operate independently.

- The second line identifies controls to be carried out by the first line. These controls are formally designed and seen as the baseline controls, typically based on objective best practice frameworks such as COSO, COBIT, or ISO standards.

- Ownership in the first line is often still limited. Executing control measures is sometimes perceived as “additional work,” carried out with some resistance or delegated to an internal control function.

- Where law & regulation or guidelines apply a compliance officer is appointed.

- The external auditor is the party that tests the operational effectiveness of controls. The auditor is the organisation’s “control conscience,” and their findings are used as a checklist to achieve adequate control.

- A third line or internal audit function is limited present. If an internal auditor is appointed, their core responsibility typically lies in stimulating collaboration.

The role of the 2nd line

At this level, the organization begins to recognize the importance of structured risk and compliance management. While still largely compliance-driven and operationally focused, there is a noticeable shift from reactive firefighting to basic process definition, role clarity, and policy development. The organization is laying the foundation for a more integrated and proactive approach in the future.

- Risk and compliance professionals introduce standardized processes for identifying, assessing, and addressing risks. They ensure that policies are not only documented but also communicated and followed. This supports consistency in decision-making and operations across departments.

- While still in the early stages, one of the key roles of risk & compliance is to raise awareness and embed risk thinking into day-to-day operations. This includes:

- Promoting policy adherence.

- Delivering basic training.

- Encouraging incident reporting and open communication

- The organization begins to conduct structured risk assessments—usually at the business unit or process level. Risk registers may be introduced, with risks rated by impact and likelihood. While these assessments are not yet integrated into strategic planning, they begin to inform operational decision-making.

- Risk and compliance play a critical role in preparing for external audits, regulatory reviews, and certifications. Their work ensures the organization has a documented trail of controls and procedures to demonstrate due diligence and control effectiveness.

- Most risk & compliance activity at this stage is driven by external requirements, such as industry regulations, contractual obligations, or audit recommendations. The focus is on “ticking the box” rather than using risk as a tool to support business performance.

- However during this stage, compliance management becomes more than a checklist—it evolves into an active effort to monitor adherence to rules and track non-conformities, leading to defined corrective actions and follow-ups.

- The organization begins to define governance roles—often appointing compliance officers, risk coordinators, or internal control specialists. These roles may not yet sit at the strategic table but start to build awareness across functions.

- Foundational governance, risk & compliance policies (e.g., anti-fraud, privacy, code of conduct) are developed and disseminated.

- Key internal controls are documented and communicated, particularly in high-risk areas such as finance, HR, and IT.

- The risk & compliance function takes on a more advisory role and begins developing an Risk/Compliance charter, Risk & Compliance plan, and test programmes.

- Risk assessments and compliance checks may occur annually or in response to audits. However, the process is often manual, spreadsheet-driven, and lacking consistency.

- The role of risk and compliance at this stage is to solidify foundations and prepare for integration into business decision-making. Priorities include:

- Strengthening the risk register and beginning to link it with business objectives.

- Enhancing the consistency of control documentation and monitoring.

- Standardizing compliance reporting and introducing periodic reviews. \

- Gaining leadership support to elevate risk and compliance into governance and performance discussions.

- Exploring automation tools and platforms to reduce manual workload and improve insight quality.

- Technology can accelerate the achievement of this maturity level, enhance collaboration between the lines, and make the risk management process more efficient.

How BR1GHT can support

We support organisations in the following ways:

- Boards and management in assessing and strengthening their ambition and vision for internal control. We translate this into effective programmes to enhance governance and internal control. We offer this support in the role of consultant, coach, or trainer.

- Delivering improvement programmes by providing key roles, ranging from project leaders to experts offering support in specific areas of expertise.

- Assisting with the selection of the right technology (for governance, risk management, and internal audit), and ensuring effective and efficient implementation based on our extensive knowledge and experience.

- Providing content in the form of frameworks and best practices, and guiding organisations in setting these up effectively – optionally integrated into our technology.

- Assessing key functions such as risk management, compliance, and audit. We offer concrete recommendations and help establish the necessary preconditions, from drafting charters, processes, policies, and procedures to creating manuals.

- Delivering training and coaching programmes for every actor in the Three Lines Model. This can be a one-time engagement or an ongoing service through annual support contracts.

- Assisting SAP-based organisations in reviewing license structures, authorisations, and security settings, and supporting their proper configuration. We can also structurally co-source these services.

- Providing co-sourcing for controls testing, where we develop robust test plans, define appropriate test procedures, and ensure that testing activities are auditable (for third parties, including external auditors), optionally supported by our technology.

Risk & compliance actively integrated

The context defined

At Level 3, the organization experiences a significant transformation: risk and compliance evolve from being reactive and operational to becoming integrated, systematic, and value-adding functions. This is a pivotal phase where governance structures mature, accountability is formalized, and risk-informed decision-making becomes part of the business fabric.

The governance environment can be described as managed with a focus on providing assurance that all controls are working (have worked over a certain period) – operating effectiveness. This assurance can be provided (on specific areas) by third parties in the form of assurance statements or by the organisation herself (internally and to third parties via voluntary oversight).

The organization no longer sees risk and compliance as box-ticking or audit-driven activities. Instead, they are recognized as essential enablers of strategic objectives, business continuity, and organizational resilience.

- Commonly seen across entire organisations in regulated sectors such as the financial industry (e.g., Basel III), pharmaceuticals (FDA/EMA), utilities providers, and telecom.

- Organisations where specific parts of operations are regulated – multiple tax jurisdictions, construction companies (EHS), financial start-ups (AML/PSD3), international trading companies (export controls involving restricted countries).

- In specialised domains, such as technologically advanced organisations where security incidents can cause significant disruption.

- Listed companies, where the control environment as a whole is subject to external audits/inspections (e.g., financial reporting requirements under SOx).

- IT service providers, where part of the client’s control execution is outsourced.

Characteristics

- Risk and compliance processes are no longer isolated within departments. They are embedded across the enterprise, with coordinated frameworks, shared methodologies, and common taxonomies.

- The organization has formal governance structures such as risk and compliance committees, clear lines of accountability, and reporting to senior leadership or the board. Roles like Chief Risk Officer (CRO) or Chief Compliance Officer (CCO) are typically established.

- Internal control is essential because the license to operate — and therefore business continuity — is at risk. This need is deeply embedded in the culture of checks and balances throughout all layers of the (partially) regulated organisation.

- Decisions at all levels—from operations to strategic planning—are increasingly guided by structured risk assessments, scenario analyses, and key risk indicators (KRIs). Risk appetite is defined and used as a reference in business decisions.

- Risk and compliance performance is measured regularly through dashboards, internal audits, and assurance activities. Issues are logged, tracked, and remediated with oversight.

- Organizations begin deploying GRC tools, compliance monitoring platforms, and risk analytics to support decision-making, automate routine controls, and visualize data.

- Monitoring and (centralised) reporting through combined assurance are vital for effective oversight.

- The Three Lines Model is normatively implemented (sometimes as a mandatory regulatory requirement). Each line has clearly defined charters, effectiveness is monitored via KPIs, and there is a high degree of collaboration between the lines.

- Emphasis is placed on testing operational effectiveness of controls by the business itself. In some cases, the business is supported by an internal control function.

- In large international organisations, functional silos may develop within compliance areas, sometimes supported by their own specific technologies.

- Parts of operations are frequently assessed by third parties (such as external auditors) and issued with formal assurance reports. Examples include ISAE 3402 for IT service provider control frameworks, COS 3000, or SOC 1, 2, or 3 reports.

- More mature organisations strive for transparency with regulators, reporting on the functioning of control measures and proactively sharing all findings, issues, and mitigating actions.

- The same level of transparency is often extended to partners or customers (from the perspective of an IT service provider) when there is a shared interest in joint value creation. As transparency increases, the need for costly external assurance reports may diminish.

The role of the 2nd line

At this maturity level, the role of risk and compliance shifts toward strategic enablement, operational alignment, and continuous improvement:

- Risk and compliance leaders are now embedded in business planning cycles, change initiatives, and investment decisions. They help anticipate future risks, evaluate the risk-return balance of new ventures, and ensure controls are proportionate to objectives.

- The focus turns to driving process consistency, control effectiveness, and efficiency. Risk and compliance teams help streamline business processes by identifying control redundancies or inefficiencies and using technology and data to optimize compliance efforts.

- Rather than simply reacting to incidents, the organization builds the capacity to predict and mitigate emerging risks. It uses scenario planning, trend monitoring, and horizon scanning. Cyber risk, ESG risk, and third-party risk become key areas of attention.

- The risk and compliance culture becomes more visible. Managers at all levels are aware of their responsibilities and take ownership of compliance within their teams. There is an emphasis on ethical behavior, transparency, and proactive issue escalation.

- The “Three Lines of Defense” model is actively practiced. Risk and compliance functions work closely with internal audit to validate control effectiveness and provide a cohesive picture to leadership.

- To move toward the highest maturity level, organizations must:

- Deepen integration of risk with strategic planning and performance management.

- Automate key control monitoring and risk reporting.

- Use real-time data and predictive analytics to anticipate and act on risk early.

- Strengthen the use of insights from internal audit, compliance testing, and external intelligence.

- Foster a learning culture where risks and failures drive innovation and resilience.

How BR1GHT can support

- Boards and management in assessing and improving their ambition and vision for internal control. We translate this into concrete programmes that enhance governance and internal control. We provide this support as consultants, coaches, or trainers.

- Filling key roles in improvement programmes — from project leaders to specialists with specific domain expertise.

- Enhancing technology for governance, risk management, and internal audit — including analytics, solution integration, controls automation, and AI.

- Providing operational consulting to second-line functions. We assess these functions, advise on more effective design, and help implement improvements.

- Co-sourcing all lines, creating an immediate quality boost while also controlling costs.

- Co-sourcing specific second-line themes, such as DORA, SIRA, or AML/CFT.

- Delivering training and coaching programmes for every actor within the Three Lines Model. These can be one-off or ongoing via annual service contracts.

- Supporting SAP-based organisations in evaluating and improving license structures, authorisation mechanisms, and security. We can also co-source these activities on a structural basis.

- Supporting internal audit with pre-assessment services — from (initial) assessments to (compliance) readiness improvement (using our own or best practice maturity models).

- Co-sourcing the risk/compliance function as a whole.

- Co-sourcing specific elements of risk & compliance, such as operational support to ensure AML/KYC or targeted support in areas such as IT and operational risk management.

The 2nd line as a real-time, strategic, tech-enabled partner

The context defined

At Maturity Level 4, risk and compliance management are no longer treated as supporting functions—they are fully integrated into the organization’s DNA. The governance environment can be described as optimised, with a focus on conveying trust to specific stakeholders and/or society as a whole.This is a state where governance is not only efficient but strategically enabling. The organization manages uncertainty and complexity with confidence, using insight, foresight, and ethical leadership as competitive advantages.

Here, the approach to risk and compliance is dynamic, data-driven, and continuous. It enables innovation, guides investment, and shapes long-term strategy. This is not compliance for compliance’s sake, nor risk avoidance out of fear—it is risk intelligence, embedded deeply in decision-making.

Factors contributing to this context include:

- The general typology of the organisation.

- The company’s specific risk profile.

- The number of years the organisation has been active and stable.

- The quality of management and the presence of key actors, including their insights and expertise.

- The ambition and decisiveness of the leadership.

Characteristics

- This organization anticipates change, rather than reacts to it. Whether it’s a shift in regulations, a geopolitical event, or a cyber threat, the organization already has the models, data, and controls in place to detect, assess, and respond in real time.

- Risk and compliance are monitored continuously using automated systems. Tools like Continuous Control Monitoring (CCM), real-time dashboards, and predictive analytics provide executives with live insights. These systems detect anomalies, trigger alerts, and even self-correct certain issues—long before human intervention is required.

- Instead of waiting for annual audits or quarterly reports, decision-makers can access live risk indicators, control statuses, and compliance metrics on demand. These insights are not just backward-looking—they are forward-focused, allowing the organization to see around corners and act ahead of crises.

- Core business processes involve minimal human intervention and are highly automated – platforms, content providers, banks, etc.

- Culture is at the heart of this maturity level. Risk awareness is woven into every layer of the organization, from front-line teams to board members. Employees don’t see compliance as a burden—they see it as part of how they do their jobs well. Managers routinely factor risk and control considerations into operational and strategic planning.

- The organization promotes a speak-up culture and psychological safety, encouraging transparency, accountability, and ethical behavior. It has a clearly defined risk appetite, which is embedded into performance goals and reward systems. Decision-makers are empowered to take risks—but within a well-understood framework of boundaries and responsibilities.

- Transparency and trust is the norm to add value – organisations under public scrutiny (due to activism or public pressure), or to those functioning as partners in a value chain technologically integrated (e.g., Bol.com and all its suppliers and partners).

- At this level, risk and compliance do not merely support strategy—they help shape it. Executives rely on these functions to:

- Evaluate the risk-reward balance of new ventures or product launches

- Inform ESG and sustainability efforts.

- Manage reputational risk and brand trust.

- Navigate complex, multi-jurisdictional regulatory environments with agility.

- These functions are also instrumental in business resilience and continuity planning. They help the organization prepare for uncertainty—be it economic volatility, climate impact, cybersecurity threats, or supply chain disruptions—so it can respond quickly and recover stronger.

- Governance is integrated with that of partners. Interdependencies are made explicit and translated into shared responsibilities, control measures, and information needs – IT-service providers.

- All governing bodies require unified insights into the quality of the internal control system. These insights are provided via dashboards with drill-down capabilities.

- (Integrated) dashboards are shared with partners (or co-developed and co-managed), where the organisation has reversed the reporting flow to on-demand insight — meaning the partner accesses data whenever they wish, instead of waiting for periodic reports.

- To build trust, transparency is essential. And to be fully transparent, control measures must function continuously. Any issue can create uncertainty. The nature of controls shifts towards fully automated, repressive (impact-limiting) measures, including automated remediation.

- Technology plays a central role at this stage. The organization leverages:

- Automated compliance workflows

- Real-time dashboards and AI-driven analytics

- Advanced data governance platforms

- Third-party risk management tools

- Integrated GRC systems that connect across business units, functions, and geographies.

These tools free up human capacity, enhance accuracy, and allow the organization to focus on value-added analysis and continuous improvement.

The role of the 2nd line

At Maturity Level 4, the organization operates as a highly mature, resilient, and risk-intelligent enterprise. In this environment, the Second Line of Defense—which includes risk management, compliance, internal control, and related functions—evolves far beyond a monitoring or advisory role. It becomes a strategic partner, a real-time enabler of business decision-making, and a central actor in driving performance, integrity, and long-term value creation.

- The second line at this level functions within a fully integrated governance ecosystem. It works closely with the first line (business units and operations) and the third line (internal audit), supported by technology, real-time data, and a culture of ownership and accountability.

- Rather than acting as a bottleneck, the second line enables speed with control. It provides guardrails—not roadblocks—so that the organization can move fast without losing sight of regulatory, reputational, and ethical boundaries.

- The second line advises on risk, compliance, and control at the earliest stages of decision-making—during strategic planning, innovation, investments, and transformation.

- It brings forward-looking insights to executive discussions, helping leadership evaluate risks associated with new markets, ESG goals, M&A activities, digitalization, and more.

- This advisory role is data-driven, leveraging predictive analytics, AI tools, and risk simulations to enable better choices—not just safer ones.

- The second line maintains and continuously improves the enterprise-wide frameworks for:

risk management, compliance, internal control, policy governance, ethics and integrity programs.These frameworks are no longer static documents. They are digitally enabled, automated where possible, and integrated into operational systems so that compliance and risk responses are part of the daily workflow.

- Leveraging automated controls, real-time dashboards, and exception alerts, the second line tracks key indicators across the enterprise.

- It moves from periodic reviews to continuous monitoring, enabling early detection of control breaches, emerging risks, or shifts in risk profiles.

- Controls are designed to be adaptive, adjusting in response to dynamic business and risk environments.

- The second line facilitates a risk-aware culture by empowering the first line with tools, training, and support.

- It provides clear guidance without taking away ownership. In this model, business leaders understand that they are responsible for managing their own risks—with the second line acting as an enabler, coach, and quality assurer.

- Compliance is no longer something imposed—it is something internalized.

- One of the most critical functions is consolidating risk intelligence across silos into a coherent enterprise view.The second line synthesizes input from operational units, external sources, internal audit findings, and analytics platforms to present actionable insights to the board, audit committee, and regulators.

- Reporting is strategic, transparent, and continuous, shifting the dialogue from “What went wrong?” to “Where are we exposed?” and “How can we stay ahead?”

- The second line acts as a bridge between the board and the business, coordinating among functions such as legal, finance, IT security, procurement, and operations to ensure alignment with risk and compliance expectations.

- It supports the board’s oversight role with scenario modeling, control assurance, and dynamic risk updates—enabling faster, more confident responses to emerging challenges.

How BR1GHT can support

In addition to our services at maturity level III, BR1GHT offers support in the following areas:

- Sparring sessions with boards and management to help shape and strengthen internal control. We translate improvement opportunities into innovation-driven programmes with a strong focus on continuous improvement. We act as consultants, coaches, or trainers.

- Reinforcing continuous improvement by providing experts in specific areas such as continuous controls monitoring, dashboarding, and business intelligence.

- Enhancing technology through continuous controls monitoring platforms as joint innovation projects.

- Providing training and coaching programmes for all actors in the Three Lines Model. These can be delivered as one-time engagements or as part of an annual service contract.

- Supporting internal audit in developing sufficient IT knowledge and experience, and redefining its priorities and focus areas.

- You focus on conveying trust, while we co-source your operational activities to realise the ambition of being proven and transparently in control.

Read what clients think about us

Expert R&C outplacement

We provide two types of people consulting services:

Interim CRO/CCO or Risk/Compliance Lead Services

Placing experienced professionals in temporary CRO, CCO or key Risk/Compliance Lead roles to ensure continuity and leadership. This includes supporting organisations in stabilising or restructuring their audit function during leadership changes, and deploying experienced professionals to manage risk & compliance management during organisational crises, mergers, or major risk events. Our specialists start with a structured 100-day plan to enhance quality, implement strategy, and transfer critical knowledge – ensuring lasting impact.

Staff augmentation

- ZRisk & Compliance professionals - Conducting risk/compliance assessments or assisting with the execution of risk/compliance programs when additional capacity is needed or when you need specific expertise in IT, ESG or emerging themes such as ISQM, DORA, SIRA.

- ZRepetitive & High-Volume Risk & Compliance Management Support - Assisting with recurring tasks such as KYC/CDD, risk (pre) assessment file accumulation, documentation reviews, and compliance readiness.

Maturity & capability development

Our solution – what we do

Your value

- ZIdentify gaps and improvement areas across people, process, and governance

- ZBuild a fit-for-purpose internal audit function with clear roles and objectives

- ZStrengthen team capability through structured development plans

- ZOptimise the operating model for greater relevance and performance

- ZAlign risk & compliance practices with stakeholder expectations and best practices (e.g. COSO)

- ZEnable long-term growth through sustainable maturity progression

Effective lines collaboration

Our solution – what we do

Your value

- ZClarify and formalise roles between the three lines

- ZReduce duplication through aligned planning and reporting

- ZAddress past risk, compliance or audit findings with hands-on improvement support

- ZBuild a roadmap for continuous alignment with best practices

- ZIncrease credibility with stakeholders and external reviewers

- ZEnsure long-term compliance readiness across processes and documentation

Compliance readiness

Our solution – what we do

- Perform structured assessments against applicable laws, regulations, and standards (e.g. GDPR, SOx, ISO 27001, DNB, AML/KYC). With the use of standardized control frameworks and compliance checklists (e.g., COBIT, COSO, NIST) we help you make risk-based gap analyses, identifying non-compliant areas and potential exposure points.

- Our Gap Assessment service offering is often helpful to newly hired CROs & CCOs and those coordinating efforts to adhere to new regulations newly developed internal standards in order to meet strategic ambitions.

Your value

- ZInternal and external recognition of risk & compliance professionalism.

- ZRecognition of risk & compliance quality.

- ZGreater efficiency (reduction of duplicate work – shorter audit timeline).

- ZImproved internal control quality (risk management follows professional frameworks (e.g COSO) and enhanced documentation, consistency and discipline).

- ZStronger collaboration and transparency raises the strategic profile and visibility of risk & compliance.

- ZMotivated risk & compliance staff working closer together with the third and fourth line.

- ZBest practice technology to support the professional Risk & Compliance function.

- ZReduction of effort (time spent by the organisation) when undergoing external inspections and audits.

- ZReduction in audit findings and external audit costs.

Training & coaching

Our solution – what we do

Your value

- ZStrengthen Champions' ability to maintain and improve your GRC software environment

- ZImprove risk & compliance effectiveness through tactical training and coaching

- ZAlign system capabilities with strategic risk & compliance ambitions

- ZSupport onboarding of new Champions and risk & compliance professionals with best-practice guidance

- ZGet hands-on support, training updates, and real-time troubleshooting

- ZBuild a confident and future-ready risk/compliance team through structured development

Read what clients think about us

Co-sourcing of risk & compliance

- ZOperational - We do operational activities such as executing recurring tasks as controls testing, compliance monitoring, CRSA, and report support. We also can do all your operational supporting tasks around your technology, such as the champions role to improve the usage of the technology. You can focus on value adding work.

- ZRisk & compliance areas and themes - We co-source specific risk & compliance areas, such as SIRA, Operational Risks, IT, IT-security, SOX, or ESG during a specific period. Given a defined budget, we set-up the plan, execute the work and report with full-coordination. Our co-souring can also focus on specific themes, such as VRM, AML/CFT, DORA, and so on.

- ZFull function - We co-source the full risk and or audit function from plan, risk assessments, CRSA, issue tracking to report. Our services can include the implementation of best-practices (frameworks) and the audit technology to support the risk and compliance processes.

- lack risk & compliance leadership capabilities (new departments or retiring Risk Managers or Compliance leads),

- need flexible workforce for a fixed period of multiple years (resource scarsity),

- need specific expertises, like DORA, IT-security or IT, and so on,

- need to install fast risk & compliance quality improvements,

- are too small to self establish and maintain a full risk or compliance function,

- want to reduce risk & compliance costs,

- need to show compliant files,

- want to improve added value to boards.

- Our co-sourcing model focuses on building long-term partnerships that align with your strategic goals.

- By combining our deep risk & compliance expertise with innovative technology, we help optimise your risk & compliance function and drive value across the organisation.

- We provide you with cost effective highly qualified Dutch and English speaking staff from our managed service centres in South Africa and Suriname combined with local staff speaking your language at your office (feet on the ground).

- From day one, we ensure that our approach aligns with your vision, offering consistent and reliable support that evolves with your needs.

- With BR1GHT, you gain more than just additional resources – you gain a trusted partner dedicated to helping your risk & compliance functions succeed.

VRM

vendor risk management

CM

compliance monitoring

AML / CFT

anti-money laundering and combating the financing of terrorism

SIRA

systematic integrity risk assessment

PSD3/PSR

payment services directive 3 / payment services regulation

ISQM

international standards on quality management

Our BR1GHT Co-Sourcing Solutions

Technology & champions co-sourcing

- We provide best in class technology to optimize your processes, plus

- We provide the champions role within your function, making sure your people always gain the maximum value out of your technology, pus

- We provide 1st and 2nd line support to your people.

Process co-sourcing

-

We perform the co-sourcing activities in the defined processes.

-

We focus on repetitive work; you focus on value adding services.

-

Seamlessly working together with your people.

-

Under your direct supervision in your strategy.

-

In our or your quality and IT-systems.

-

Process monitoring & reporting.

Full function co-sourcing

-

We co-source the full function, including B and optional A.

-

We deliver the CAE, CRO, CCO or Internal Control lead.

-

We act fast.

-

We improve all operational requirements (procedures, etc.) given your function a quality boost.

-

We define the strategy and fucus on strategic value.

How to realise good governance

After more than 30 years working in the area of good governance and internal control, we see many organisations still struggling to realise the right level of internal control. Many are below the desired level to manage their risks sufficiently, while others are tired of implementing even more controls and…

The 10 most critical emerging risks for the financial sector in 2025

The financial sector is facing unprecedented challenges as we move into 2025. Rapid technological advancements, shifting global dynamics, and evolving regulatory landscapes are creating an environment where identifying and managing emerging risks has never been more critical. In this article, we explore the 10 most pressing risks that financial institutions…

The future of compliance 2030 I Gartner

In an evolving regulatory landscape, organizations face increasing pressure to ensure their operations align with stringent compliance standards while effectively managing risks. The choice of a Risk & Compliance solution plays a crucial role in achieving this balance, enabling businesses to identify, monitor, and mitigate risks while maintaining operational integrity.…

Essential tactics to elevate emerging risk management I Gartner

In today’s volatile business environment, emerging risks pose a significant challenge for enterprise risk management (ERM) leaders. These risks, often abstract and distant from immediate business priorities, require a forward-looking, strategic approach to ensure organizational resilience. Effective management of emerging risks is not just about identifying potential threats but also…

Global risks report 2025 I world economic forum

As we step into 2025, the global risk landscape is becoming increasingly fragmented, marked by intensifying geopolitical tensions, environmental crises, societal polarization, and technological disruptions. The Global Risks Report 2025 sheds light on these complexities, offering insights into the immediate, short-term, and long-term risks that are shaping our world. This…

How to realise good governance

After more than 30 years working in the area of good governance and internal control, we see many organisations still struggling to realise the right level of internal control. Many are below the desired level to manage their risks sufficiently, while others are tired of implementing even more controls and…

Building trust in the vendor risk management ecosystem I Deloitte

How can you build trust in your vendor risk management ecosystem? Organisations have three opportunities to build trust in the ecosystem mentioned below: 1. Building Trust at a Policy Development Level Organizations often have vendor-related policies, but these typically lack detailed ethical guidelines and trust-building measures. Extending ethics and compliance…

A practical approach to supply-chain risk management I McKinsey & Company

In the last decade, a number of organizations have been rocked by unforeseen supply-chain vulnerabilities and disruptions, leading to recalls costing hundreds of millions of dollars in industries ranging from pharmaceuticals and consumer goods to electronics and automotive. And multiple government organizations and private businesses have struggled with cybersecurity breaches,…

Excited to Announce: BR1GHT is the First Gold Partner of RiskChallenger

We are excited to announce that BR1GHT is the first Gold Partner of RiskChallenger! This collaboration enables us to provide our clients with a dynamic tool that simplifies risk identification, analysis, and control, fostering a proactive risk management culture. By combining RiskChallenger\'s unique software features with BR1GHT\'s risk management expertise,…

Understanding risk management in the Supply Chain I Deloitte US

A business is only as strong as the chain of suppliers it works with. So leaders must recognize and work to understand the factors that promote strong risk management in the supply chain. Ensuring that your goods arrive on time is only a piece of the whole. Managing vendor relationships,…

Navigating complexity: The key to successful system implementation

Recent headlines from Sweden tell a cautionary tale: the rollout of a new IT system, Millennium, at one of the country\'s largest hospitals has reportedly led to significant disruptions. Staff have been forced back to pen-and-paper methods, patient care has been delayed, and frustration has boiled over into public protests. While…

Bridging the Adaptation Gap in GRC Systems: How to Maximise Long-Term Value

Governance, Risk, and Compliance (GRC) systems have become essential technologies for organisations to manage risks, meet regulatory requirements, and ensure internal processes run according best control practices. However, many businesses face a common challenge after system implementation. End users often struggle a long period to fully adopt the new system.…

Collaborating with Wolters Kluwer to sell and implement Enablon as an innovative solution

BR1GHT has established itself in the market of GRC technology services, whilst also offering a select team of knowledgeable consultants, with skills to provide GRC consulting and implementation services. Together, with Wolters Kluwer, we help our clients to select, embed and embrace their Enablon technology. Our primary focus being on…

BR1GHT is Attending the ISACA Risk Event 2024 on 6 Nov 2024!

We are excited to announce that BR1GHT will be attending the fifth edition of the ISACA Risk Event on Wednesday, November 6, 2024, celebrating their first lustrum! This event offers a fantastic opportunity to meet our peers, gain knowledge, and share insights. The ISACA Risk Event, organized in collaboration with…

Job – Consultant at BR1GHT

We are looking for two experienced consultants to complement our Surinamese team. In this role, you will advise clients on (software) solutions for risk management, compliance and/or (IT-)security. This includes pre-sales, demos, application implementation and specialist consulting. You don’t need to be a specialist in all areas, but if your…

Specialist consulting by BR1GHT

BR1GHT helps clients to gain value in all governance areas with technology, specialist consulting and managed services. With specialist consulting we focus on selecting the right technology and improving the use of technology by the governance functions within the organisation of our clients: internal control, risk management, compliance and internal…

BR1GHT achieves 90% reduction in EVBOX’s SAP security risks

BR1GHT conducted a baseline assessment to identify risks in EVBox's SAP Authorization design. Subsequently, EVBox decided to address these risks by redesigning its SAP Authorizations, aiming for a robust and secure SAP environment.

Wolters Kluwer named Global Leader in ESG Software

Our partner Wolters Kluwer has been named a Global Leader in ESG Software. Read all about it here and contact us to learn how these solutions can elevate your ESG efforts.

Gene Tjong Akiet joins BR1GHT’s Netherlands team from Suriname

We are excited to announce that Gene Tjong Akiet, a valuable member of our team in Suriname, will be joining us in the Netherlands to continue his work with BR1GHT. Gene\'s contributions to our team have been instrumental in the growth and success of our business, and we are thrilled…

BR1GHT implemented ING’s compliance monitoring system

In September 2020, the Compliance Quality Assurance (CQA) department was established within ING. This department, even more than its predecessors, had the need to conduct thematic or process-oriented compliance reviews. Since the audit function uses TeamMate, and the collaboration with BR1GHT/Wolters Kluwer made us decide to opt for TeamMate to…

BR1GHT @GRC conference Stockholm 26 June 2023

BR1GHT will join one of Europe's biggest conferences on GRC on the 26'th of June 2023. BR1GHT is a global technology solution provider for all the GRC functions within a company; from first line business & finance controls, IT controls & security, GRC & risk management, compliance, and internal audit…

BR1GHT @ TeamMate European user forum 2023

March 16, 2023 we as a partner of @Wolters Kluwer TeamMate Audit Solutions part of the TeamMateEMEAForum2023, we had the opportunity to meet and mingle with many of our customers and have the great opportunity to learn from industry thought leaders and TeamMate deep-domain experts. The BR1GHT team very much…

Cerrix: launces new audit management module

LANCERING NIEUWE AUDIT MANAGEMENT MODULE! Wilt u ook meer weten over geïntegreerd werken in 1 GRC & Audit solution, neem dan contact met ons op!